Individual income tax returns for 2021 will be due April 18th, 2022. In preparation as we head into the tax season, here are some facts to consider.

- Where your tax dollars go.

In 2021, the federal government spent $6.82 trillion, which equals 30% of the nation’s gross domestic product. Three significant areas of spending make up the majority of the budget. Medicare accounted for $696.5 billion, or 10%. Defense spending made up $754.8 billion, or 11% of the budget, was paid for defense and security-related international activities. Seventeen percent of the budget, or $1.1 trillion, was paid for Social Security, which provided monthly retirement benefits averaging $1,497 to 46 million retired workers.

- How long you should keep tax documents.

The IRS provides the following recommended timelines for retaining financial documents:

- You should keep your tax records for three years if #4 and #5 below do not apply to you.

- You should keep records for three years from the original filing date of your return or two years from the date you paid your taxes. Select whichever is the later date. This is if you claimed a credit or refund after you filed your return.

- You should keep your records for seven years if you claimed a loss from worthless securities or a bad debt deduction.

- You should keep your records for six years if you failed to report income that you should have, and the income was more than 25% of the gross income listed on your return.

- Keep records indefinitely if you do not file a return.

- You should keep employment tax records for at least four years after the due date on the taxes or after you paid the taxes. Select whichever is later.

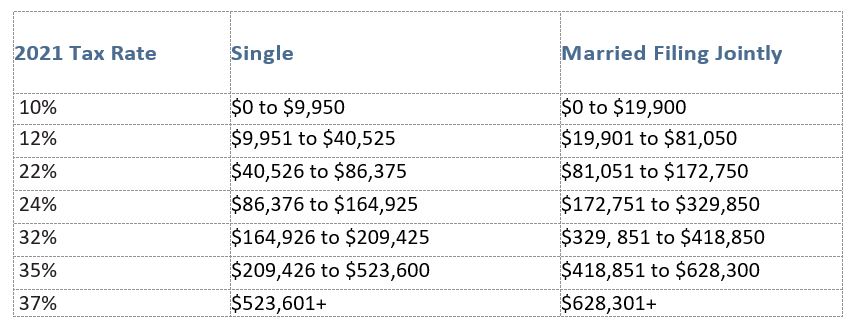

- Tax brackets for 2021 individual income tax returns.

NOTE: These tax rates are scheduled to expire in 2025 unless Congress acts to make them permanent.

- Tax brackets for 2022.

When it comes to taxes, it’s always a good idea to plan ahead. In November 2021, The Internal Revenue Service announced that it is boosting federal tax brackets for 2022 due to faster inflation. Below is a breakdown of the new thresholds for the seven tax brackets in 2022:

10%: Single individuals earning up to $10,275 and married couples filing jointly earning up to $20,550.

12%: Single filers earning more than $10,275 and married couples filing jointly earning over $20,550.

22%: Single filers earning more than $41,775 and married couples filing jointly earning over $83,550.

24%: Single filers earning more than $89,075 and married couples filing jointly earning over $178,150.

32%: Single filers earning more than $170,050 and married couples filing jointly earning over $340,100.

35%: Single filers earning more than $215,950 and married couples filing jointly earning over $431,900.

37%: Single filers earning more than $539,900 and married couples filing jointly earning over $647,850.

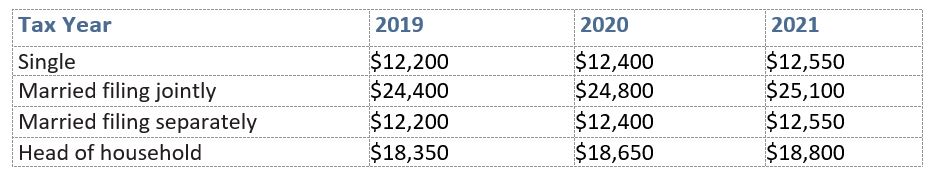

- Standard deductions.

Here is an overview of the standard deductions since 2019, including the standard deduction for the 2021 tax season:

For 2022, the IRS is increasing standard deductions due to faster inflation:

The standard deduction for married couples filing jointly will rise 3.2 percent to $25,900 next year for the 2022 tax year, an increase of $800 from the prior year. The standard deduction for single taxpayers and married individuals filing separately rises to $12,950 for tax year 2022, up $400 from tax year 2021. For heads of households, the standard deduction will be $19,400, up $600.

- You can still contribute for the 2021 tax year.

If you have not already contributed fully to your individual retirement account for 2021, April 15 is your last chance to fund a traditional IRA or a Roth IRA. Please call us if you have any questions about setting up or contributing to a traditional or Roth IRA.

Sources: IRS.gov, SSA.gov

This information is for general purposes only and is not to be relied upon or considered as financial or tax advice. It is recommended that you work with your tax professional to complete your tax returns based on your unique situation.

Call us if you’d like to speak with us about your financial plan. You can reach Drew Financial Private Capital in Florida by calling (813) 820-0069.

References to J.W. Cole Advisors, Inc. (JWCA) are from prior registrations with that company. J.W. JWCA and Advisory Services Network, LLC are not affiliated entities.