The Growing Risk to Long-Term Investor Returns

Humans are not wired to be successful long-term investors.

We are too emotional, have too many biases, and frequently make decisions outside of an established, disciplined framework. At the end of the day, we listen to “our gut” too much.

To be a successful long-term investor, one needs to inhabit the exact opposite traits. We should approach investment decisions dispassionately, with a disciplined process, and devoid of emotion and bias. Of course, that’s easier said than done.

For me to say investors are prone to missteps probably does not strike many readers as newsworthy. There is plenty of research affirming this point. For instance, the research firm DALBAR has been publishing their Quantitative Analysis of Investor Behavior report for 30 years, and it consistently shows that retail investors are underperforming markets. DALBAR’s report compares the returns equity markets are delivering versus the returns investors are realizing. There’s consistently a gap, and the 2024 report was no exception.1

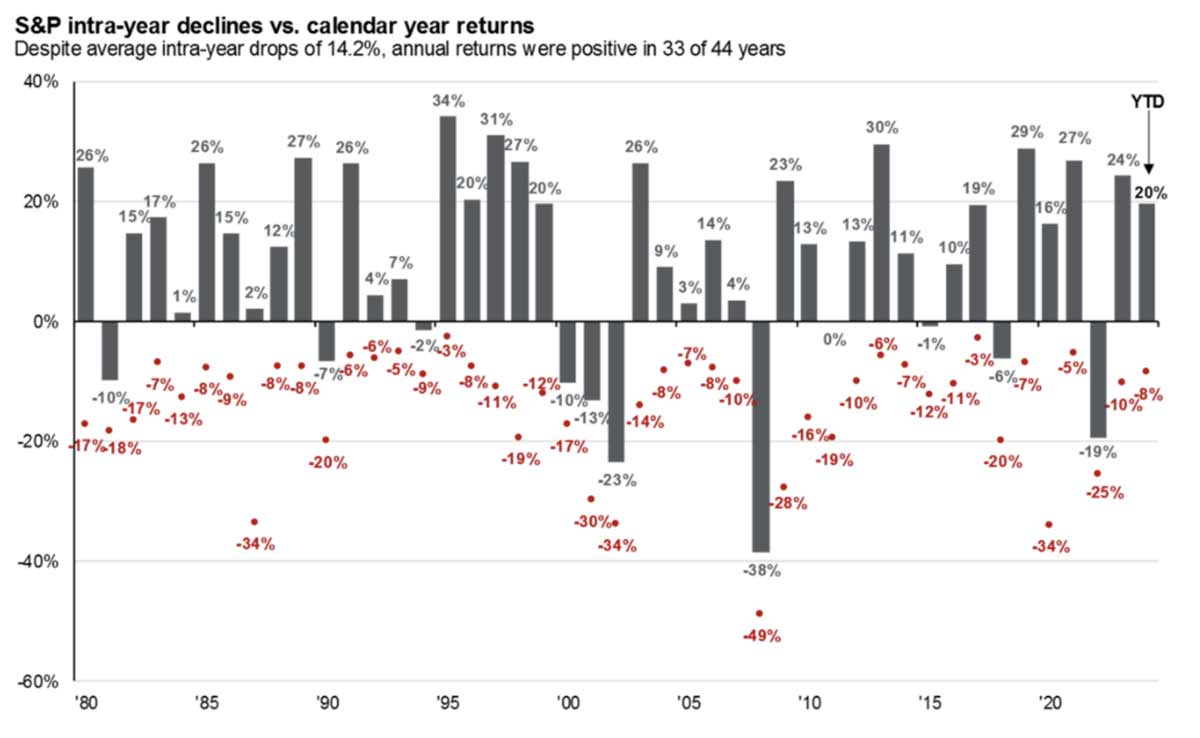

According to DALBAR, the average equity investor underperformed the S&P 500 Index by 5.5% in 2023, marking the third-largest performance gap in the last decade. Underperformance was seen in the fixed-income realm as well, with the average fixed-income investor underperforming the Bloomberg Barclays Aggregate Bond Index by 2.63%. The research continues to indicate that emotional decisions are hurting investor returns. Investors sell during downturns and miss rebounds, and they get overconfident during strong rallies. Both actions tend to hurt returns.

Zooming out to 20-year returns, the average equity investor earned an annualized return of 8.7% according to DALBAR, while the S&P 500 Index has delivered an annualized return of 9.7% over the same period. This 1% difference in annualized return may not seem like much, but on a $1M initial investment, it would mean having roughly $5.3M at the end of the 20-year period for the average investor, instead of $6.3M. Simply put, that’s huge.

As I mentioned previously, investors may be aware of this issue already. What’s new, however, is research suggesting that the problem may be getting worse.

A finance professor at George Mason University analyzed all return data for U.S. dollar-denominated mutual funds over the last 10 years, separated actively managed funds from index-tracking passive funds, and then looked at the difference between the stated annual return and the actual dollar-weighted return in the fund (known as the return gap). This gap is very similar to the one published by DALBAR—it shows the average return for the fund versus what the average investor actually experiences.

This new study confirmed what DALBAR has been saying for decades—that the average investor underperforms. What’s different is the level of underperformance observed from 2015 to 2019 (pre-Covid) compared to 2020 through October 31, 2024. In the pre-Covid period, poor market timing cost investors 0.53% per year. In the post-Covid period, however, that number nearly doubled to 1.01%. Interestingly, the area where investors are seeing the most damage to portfolios is in actively traded small-cap funds, perhaps because of information being scarcer and volatility being more prevalent. The average return gap was 0.62% before Covid, but it has grown to 1.38% since.

While this is consistent with DALBAR’s long-term finding, the more recent study suggests that the trading practices that have become popular in the wake of the pandemic—whether it’s day-trading, being actively engaged on discussion boards, experimenting with options and other derivatives, etc.—are costing investors dearly. As far as I can tell, these ‘trading strategies’ are only becoming more popular, which means the risks to investors’ long-term returns could continue growing over time as well.

Bottom Line for Investors

The retail investment community was relatively strong and growing before the pandemic, but there is a good argument that stimulus money and more time spent at the computer—combined with the proliferation of trading platforms and discussion forums—has catalyzed retail investor participation. Generally speaking, I view this trend as a good thing. It means more people are investing in markets, which hopefully enables more people to generate wealth over time.

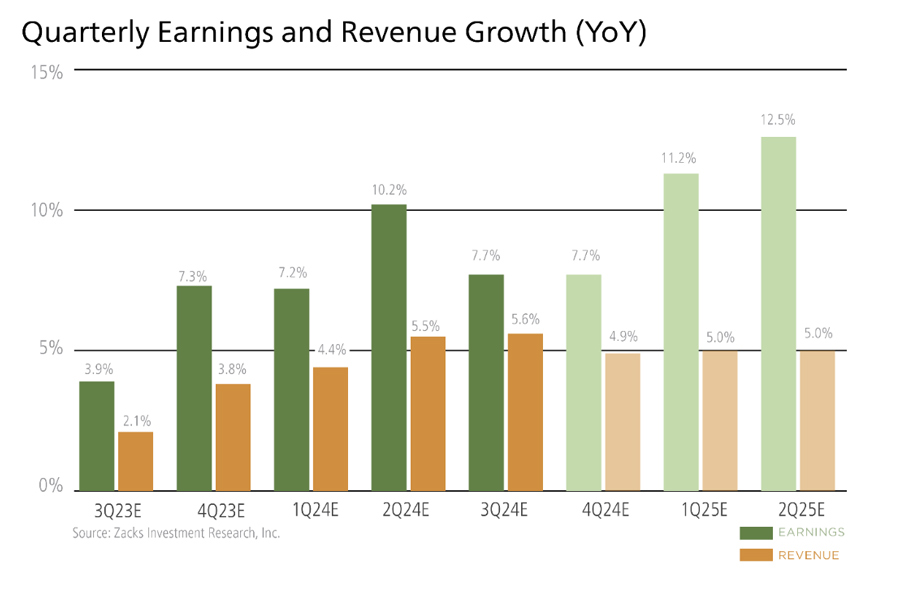

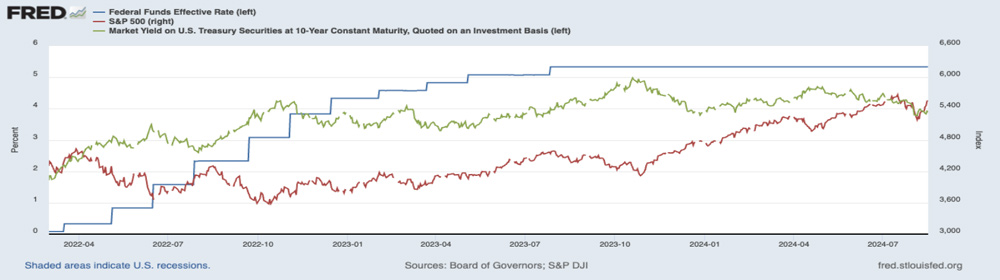

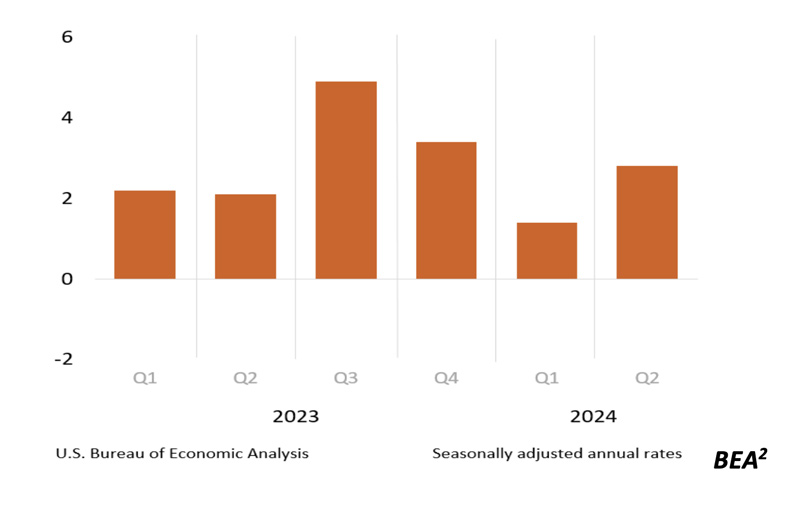

The research cited above suggests that many investors are missing the forest for the trees. Instead of owning equities long-term because investors want to participate in value creation and earnings growth, they’re focusing too much on daily price changes, event-driven market news, or the latest social media investment buzz. That’s the opposite of a long-term, disciplined approach, and it’s costing investors.

1 Wall Street Journal. December 5, 2024. https://advisor.zacksim.com/e/376582/-7e5af96a-mod-djemMoneyBeat-us/5s9yk4/1105472349/h/awbVFROscF6XrYoJa7QiRfHVECoWO88qmbvtNLwG9WI

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The ICE Exchange-Listed Fixed & Adjustable Rate Preferred Securities Index is a modified market capitalization weighted index composed of preferred stock and securities that are functionally equivalent to preferred stock including, but not limited to, depositary preferred securities, perpetual subordinated debt and certain securities issued by banks and other financial institutions that are eligible for capital treatment with respect to such instruments akin to that received for issuance of straight preferred stock. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The MSCI ACWI ex U.S. Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 24 Emerging Markets (EM) countries. The index covers approximately 85% of the global equity opportunity set outside the U.S. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Russell 2000 Index is a well-known, unmanaged index of the prices of 2000 small-cap company common stocks, selected by Russell. The Russell 2000 Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The S&P Mid Cap 400 provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P 500, is designed to measure the performance of 400 mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment.

The S&P 500 Pure Value index is a style-concentrated index designed to track the performance of stocks that exhibit the strongest value characteristics by using a style-attractiveness-weighting scheme. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.